INSPIRERANDE OCH FÖRETAGSANPASSADE WORKSHOPS

Sveriges bästa AI Workshop!

Boka en AI Workshop och kom igång med AI arbetet!

Kontakt: Arne Olafsson | arne@olafsson.se | 0701825532

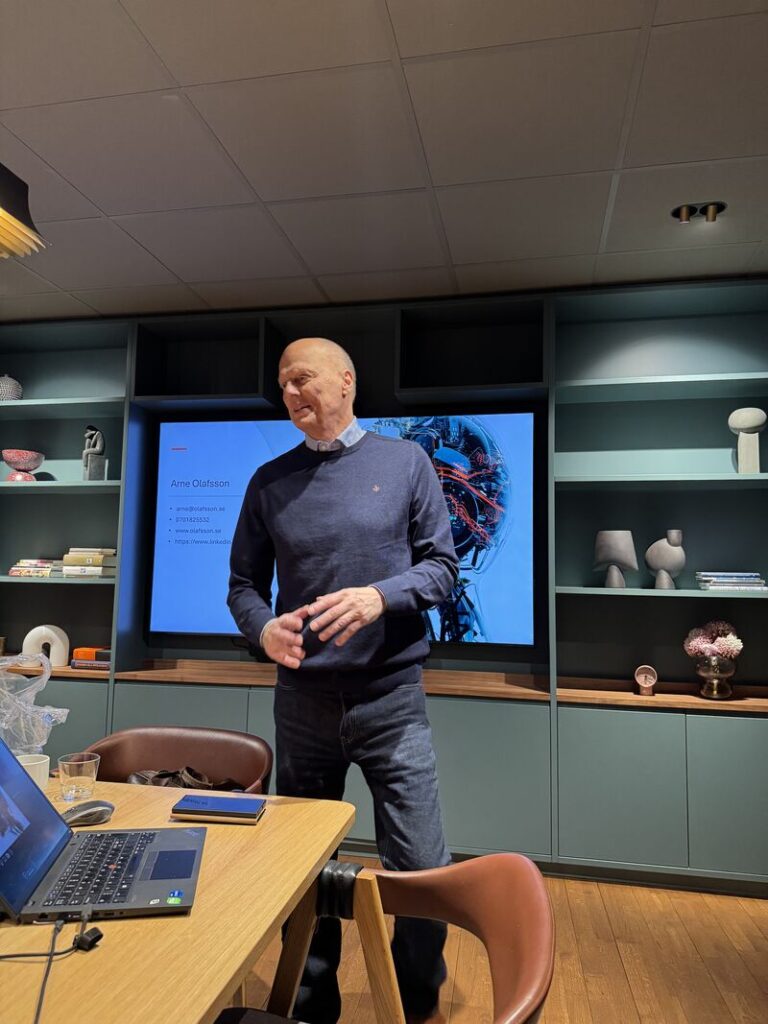

Genom våra uppskattade Workshops för företagsledare och styrelser hjälper vi deltagarna att förbättra sin AI kompetens och omsätta teori till handling.

Våra Workshops om AI skräddarsys för att möta specifika behov och önskemål, med målet att ge deltagarna konkreta verktyg, insikter och förväntningar på rätt nivå för att navigera framgångsrikt i den digitala världen.

Min bakgrund är managementkonsult med fokus på förändringsprogram för produktivitet, tillväxt, målstyrning, digitalisering och organisationsutveckling.

Workshopen passar perfekt för ägare, styrelser och ledningsgrupper som snabbt vill omsätta AI-teori till praktisk kompetens och börja utveckla en kraftfull AI-Strategi.

Fortsatt arbete med analyser, AI strategi, automatisering, implementering, uppföljning, utbildning, etc. diskuteras i nästa steg med teamet.

AI Workshop | AI Analys | Implementering

I workshopen pratar vi AI och tillämpningsområden, och realistiska resultat:

- Strömlinjeformade arbetsflöden, minska handpåläggning med 30-50%

- Lead generation, inbound och outbound

- Förbättrad kundservice genom snabb och korrekt återkoppling till kund

- Förbättrad kvalitet i alla led, minska fel i leverans med upp till 40%, med ökad kundnöjdhet, osv.

- Öka produktiviteten med upp till 30-50%, använd mantimmar till värdeskapande arbete i stället

- 90% av processkontroller automatiska, revisionsförberedelser ner 45%

- Skalbara plattformar säkerställer utrymme för tillväxt

- Osv. möjligheterna är oändliga!

I workshopen testar vi självklart ett relevant urval av AI-verktyg som t.ex:

- ChatGPT/Gemini/Copilot, tips och tricks.

- AI Verktyg som ChatBase, Midjourney, Runway, ElevenLabs, Udio, AdCreative, Invideo, Make.com, osv.

- Analys av data, excel, med ChatGPT, otroligt enkelt och givande

- Vi gör några GPT, skräddarsydda för specifika uppdrag, förändrar din arbetsdag och skapar förståelse för det större perspektivet

Boka tid direkt i kalender för att diskutera en eventuell föreläsning eller workshop, klicka här.

Kontakt: Arne Olafsson | arne@olafsson.se | 0701825532 | www.sverigestalare.se | www.kc-group.se

Vad säger andra kunder?

"Fantastisk med ett så starkt fokus på affären, inte tekniken!"

"Rekommenderas starkt!"

"Fantastisk möjlighet du gav oss Arne!!"

"Om ni vill ha en workshop med någon som verkligen förstår företagandet, ledarskap, processer och system så är Arne the man"

"Pedagogiskt, ödmjukt, strukturerat leder han sina deltagare genom hands-on AI i workshopform."

"Ingen går från workshopen utan att ha kommit igång utifrån sin nivå."

"Väldigt bra genomgång av AI Arne, pedagogiskt och en hel del bra tips att prompta och effektivisera affärsprocesserna"

"Vilken inspirerande eftermiddag med dig Arne Olafsson!!"

Är du redo att revolutionera

ditt företag med AI?

Arne Olafsson har arbetat med affärsutveckling, utbildningar, föreläsningar, coaching i över 30 år. Nu kan du boka en Workshop, AI i Fokus, som kommer att förändra din syn på framtiden. Missa inte chansen att ligga steget före!

AI i Fokus

Introduktion

En föreläsning för dig som vill komma i gång med AI, med konkreta åtgärder

AI, ett massivt paradigmskifte

Den största förändringen i vår livstid

Det är nu eller aldrig som det gäller att satsa framåt på AI, alla påverkas

Om Arne Olafsson

AI-förespråkare som specialiserar sig på att använda AI-drivna verktyg och hjälper människor att dra nytta av AI-möjligheter. Dokumenterad erfarenhet av att integrera AI med affärsutveckling.

Erbjuder Föreläsningar & Workshops med efterföljande stöd.

Ger månadsvis ut Magazinet Artificiell Intelligens, se nedan.

Fokus på praktisk tillämpning, nuläge i förhållande till målbild och prioriteringar.

Erfarenhet från mängder av branscher, nationellt och internationellt, efter mer än 30 år som företagskonsult, investerare och egen företagare.

Läs magasinet Artificiell Intelligens!

Lättläst och med aktuella ämnen

Magasinet Artificiell Intelligens juni/juli 2025

AI strategier och Micro AI, viktiga begrepp att ha koll på.

Två olika angreppssätt – båda nödvändiga. AI-strategin sätter riktningen och skapar samsyn, medan Micro AI möjliggör snabb, decentraliserad tillämpning som engagerar medarbetare och bygger AI-kompetens inifrån.

De nya AI jobben, lista och beskrivningar, stora möjligheter för nya karriärer, ökade intäkter och ett breddat tjänsteutbud – där individer kan paketera, sälja och skala sina kompetenser

Samt som vanligt mycket mer...

Magasinet Artificiell Intelligens maj 2025

Workshop, Analys, Implementering, Uppföljning

Medarbetarundersökning, möjligheter & risker

I den AI-drivna framtid vi nu snabbt kliver in i, blir kompetensförsörjning en av de absolut mest kritiska faktorerna för företags framgång.

Analysen och den mätbara potentialen

Vår AI-analys omfattar en helhetsbedömning av organisationens förutsättningar att lyckas med AI, där vi granskar sex centrala områden: data, organisation, mål, ledarskap, strategi och effektivitet

Implementering, den svåra men avgörande fasen

När implementeringen görs rätt skapas inte bara effektivare arbetssätt och ekonomiska vinster – ni får också en organisation som är redo för framtiden, där AI är ett naturligt verktyg i vardagen.

Magasinet Artificiell Intelligens April 2025

AI omformar spelreglerna – är ni redo att leda eller förlora? Läs hur ni tar kontroll nu.

I detta nya landskap får både ledningsgruppen och styrelsen nya roller, nya ansvar och nya frågor att hantera – snabbt.

Alla verktyg finns, utbildningen finns, metoderna finns, besparingspotentialen är verklig, men har vi modet att ställa om?

Potentialen är större än någonsin för de AI-pionjärer som tar omställningen på allvar redan i ett tidigt skede.

Vi står inför ett paradigmskifte av sällan skådad omfattning, men skillnaden den här gången är att tiden för att hinna reagera är mycket kortare.

Samt mycket mer...

Magasinet Artificiell Intelligens februari 2025

Kom med i paradigmsskiftet!

Miljontals människor kommer att förlora sina jobb, detta länder i med stora kluster av outsourcad kundtjänst eller liknande. ChatBotarna tar över, och det går snabbt. Det spiller sedan snabbt över till andra länder...

AI, AGI och ASI, vad står begreppen för, och har vi något att oroa oss för? Nja, vem kan svara på det? Men tävlingen till AGI är i full fart, och det gäller inte vem som gör det säkert, utan bara vem som vinner, vilka konsekvenser det får..

Det har varit svårt att hinna denna månad, många vill ha en AI Workshop för att komma i gång, men nu är februari utgåvan nästan klar. Mycket spännande och viktig läsning!

Magasinet Artificiell Intelligens Januari 2025

AI fullständigt exploderar 2025, det gäller att hänga med!

Snabbare, billigare och bättre. BCG´s studie, resultatet av studien visar att de som använde AI stöd gjorde sina uppgifter 12% snabbare, 25% fler uppgifter och med 40% bättre kvalitet. Hur påverkas resultatet av ett sådant utfall?

Hur påverkas medarbetare på kundtjänst av dessa stora förändringar, med AI kundtjänster som Kundo.se och ChatBotar?

Gästskribent Stina Ohlsson Algeskär tar upp frågan om AI tar över våra jobb, och vad göra för att förhindra detta?

Samt mycket mer...

Magasinet Artificiell Intelligens December 2024

Ledningsgruppen och styrelsen måste ta lead!

Vi berör i decemberutgåvan vikten av att ledningen och styrelsen tar lead i AI frågorna för att säkerställa att hela företaget omfattas av AI implementeringen, och att vi använder rätt KPI för att mäta framgång med AI implementeringen.

Chatbots kommer starkt 2025, vad är det, och hur påverkas vi, läs och lär dig hur de fungerar och hur du kan använda dem. Vi pratar om det nya "Gränslösa tankesättet, med de tre principerna", och mycket mer om AI, lättläst.

Läs gärna och återkom med kommentarer, eller om något saknas, ambitionen är att magasinet ska vara lättläst och beröra ett brett spektrum av AI relaterade frågeställningar.

Magasinet Artificiell Intelligens November 2024

AI för Ledare, släpp loss nu!

I Novembernumret av AI-Magazinet fokuserar vi på AI och Ledare, och hur man kommer ur AI paralysen.

Det blir en hel del inspel och ledarens roll i AI implementeringen, men också hur företagsledare kan ta fram en AI Strategi utan alltför för mycket besvär.

Vi slår ett slag för kompetensinventering avseende AI, detta för att identifiera riskerna med ett alltför stort gap mellan AI First Team och Analoga Team på arbetsplatsen. Detta kan absolut leda till konflikter på arbetsplatsen, och bör därför tas på största allvar.

Magasinet Artificiell Intelligens Oktober 2024

AI och Ledarskapet!

I oktobernumret av AI-Magazinet 2024 tittar vi lite på AI och Ledarskapet, hur AI kan stötta en ledare i dennes vardag, i allt från egen coaching till mer kvalificerat stöd. Påminner kort om statistiken, 25% bättre produktivitet och 40% bättre kvalitet hos Boston Consulting Group. Vi har lagt med några enkla arbetsuppgifter.

Läs gärna och återkom med kommentarer, eller om något saknas, ambitionen är att magasinet ska vara lättläst och beröra ett brett spektrum av AI relaterade frågeställningar.

Magasinet Artificiell Intelligens September 2024

Maximera din potential med AI!

I septembernumret av AI-Magazinet 2024 presenteras hur artificiell intelligens revolutionerar arbetsplatsen. Tidningen fokuserar på att hjälpa företag och individer att anpassa sig till AI-teknik genom reskill och upskill, med konkreta steg för att integrera AI i företagsstrategier. Du får lära dig hur du börjar din AI-resa, vikten av att lära sig prompta, samt hur AI ökar produktiviteten och kvaliteten med upp till 40%. Låt dig inspireras av framgångshistorier, utbildningsplaner och framtidsprognoser för AI's inverkan på arbetsmarknaden.

Ladda ner magasinet här

Läs på nätet här

Magasinet Artificiell Intelligens Augusti 2024

Promten, den nya måstekompetensen!

I augustinumret av AI-Magazinet 2024 pratar vi mycket vad som egentligen händer just nu, om vikten att lära sig att prompta, och grundläggande förutsättningar i AI eran. Men även om vikten av att inspirera för att andra ska komma i gång med AI. Låt dig inspireras av framgångshistorier, utbildningsplaner och framtidsprognoser för AI's inverkan på arbetsmarknaden.

Registrera dig för nyhetsbrevet, utöver magazinet får du inbjudningar till olika event och presentationer, och även riktade mindre utbildningar på teams, kan vara i grupp eller individuella.

Om du önskar individuell genomgång av ett specifikt område vänligen kontakta arne@olafsson.se eller ring på 0701825532

Arne Olafsson

Lilla Torget 5

761 30 Norrtälje

Sverige

arne@olafsson.se

0701-825532

Godkänd för F-skatt

Copyright © Olafsson Atwork Consulting AB, All Rights Reserved